If you’re considering financing a Honda vehicle purchase, you’ll likely come across American Honda Finance (AHF). As the captive finance company for Honda in the U.S., American Honda Finance provides lending and leasing options for Honda and Acura customers. In this comprehensive guide, we’ll explore everything you need to know about Honda financing.

Contents

- 1 Overview of American Honda Finance

- 2 Why Choose Honda Financial Services?

- 3 Registration for New Users

- 4 Login Process for Returning Users

- 5 Benefits of Financing Through American Honda Finance

- 6 Navigating Your Dashboard

- 7 Making Payments Online

- 8 Setting Up Autopay

- 9 Understanding Account Statements

- 10 Updating Personal Information

- 11 Exploring Additional Online Services

- 12 American Honda Finance Corporation – Supporting Honda Owners

- 13 FAQs

- 14 Conclusion

Overview of American Honda Finance

American Honda Finance Corporation is a wholly owned subsidiary of American Honda Motor Company and serves as the automotive financing and lending arm for Honda and Acura in the United States. Founded in 1981 and headquartered in Torrance, California, AHF provides indirect automobile loans and lease products to customers of participating Honda and Acura automobile dealerships across all 50 states.

The types of financing offered by American Honda Finance include:

- Retail installment contracts: These are indirect loans used to purchase new or certified pre-owned Honda and Acura vehicles.

- Lease contracts: These allow customers to lease new Honda and Acura vehicles typically for 24 to 48 month periods.

- Wholesale financing: AHF provides floorplanning and inventory financing products to dealers.

As of 2022, American Honda Finance has assets totaling over $60 billion with over 85 billion receivables outstanding and 1.2 million active contracts in dealership showrooms across America.

Why Choose Honda Financial Services?

Honda Financial Services has earned a reputation for providing exceptional customer service and user-friendly financial services to Honda owners. Here are some of the top reasons to utilize their services:

- Trusted reputation with decades of experience in the auto financing industry.

- Competitive interest rates on vehicle loans and leasing options.

- Convenient online account management and payment processing.

- Top-notch customer support via phone, email and live chat.

- User-friendly website and mobile app for on-the-go account access.

- Ability to handle all Honda-related financial services in one place.

By choosing Honda Financial Services, you can streamline financing, leasing, payments and account management for your Honda vehicle seamlessly through their online portal. Their focus on customer satisfaction ensures your financing experience is hassle-free.

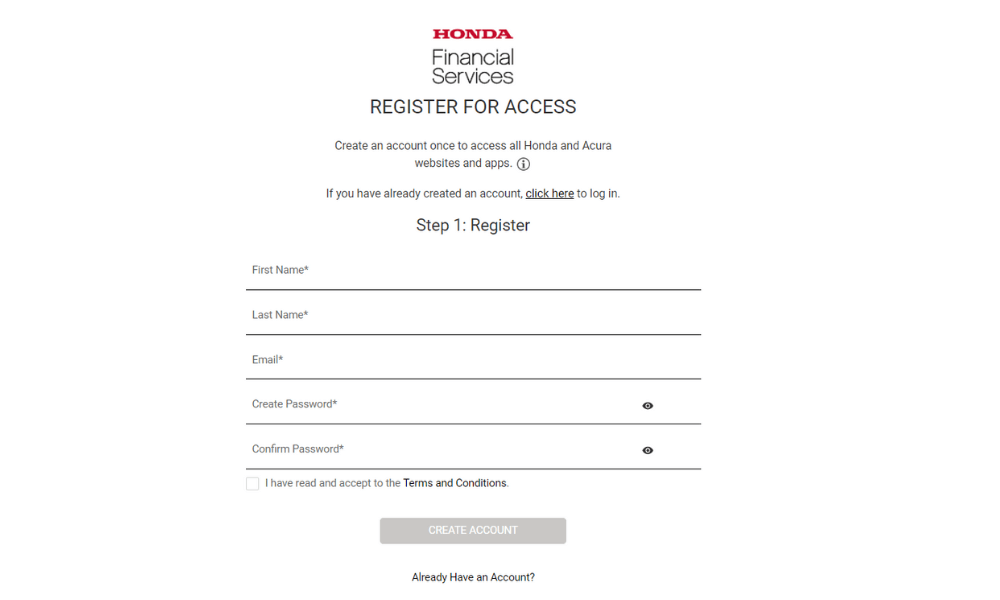

Registration for New Users

To register for an online account with Honda Finance, follow these steps:

- Go to the Honda Financial Services website and click on “Register”.

- Enter your financing account number and last name.

- Fill in your personal details like address, phone, email, etc.

- Create your username and password for login.

- Agree to the website’s Terms of Use.

- Click on “Submit” to complete your registration.

Once registered, you will receive a confirmation email with a verification code to activate your account. This completes the signup process so you can now login using your credentials.

Login Process for Returning Users

If you already have an online account, simply follow these steps to login:

- Go to the Honda Financial Services website and click on “Login”.

- Enter your username and password.

- If you have multi-factor authentication enabled, input the security code sent to your phone.

- Click on “Login” to enter your account portal.

- If you forgot your password, use the “Forgot Password” feature to reset and regain access.

By logging in, you can now access your account details, and statements, manage payments and more.

Benefits of Financing Through American Honda Finance

There are several advantages to financing your Honda purchase through American Honda Finance rather than going to an outside lender:

- Competitive interest rates are exclusive to Honda customers.

- Flexible loan terms of up to 72 months.

- Lease buyout options on Acura vehicles.

- Online account management and payment options.

- Dealer specials, incentives, and promotional financing rates.

- Autopay discounts are available in most states.

- No prepayment penalties.

- Can be bundled with Honda Care extended protection plans.

- Easy application process with fast decisions.

Additionally, AHF offers financing incentives and promotions exclusive to Honda customers several times throughout the year, especially around major annual sales events.

Once logged in, you will see the account dashboard page. This displays a snapshot of your account details, profile information, notifications and more. Key elements include:

- Account Summary – Shows current balance, next payment, due date, etc.

- Recent Transactions – Lists your most recent payments and processing dates.

- Payment Options – Different ways to make a payment like one-time, recurring, etc.

- Latest Statements – Access your monthly account statements.

- Messages – Notifications for payments, newsletter updates, etc.

- Profile Details – Manage details like contact info, email preferences, etc.

- Lease Options – Review end-of-lease options if applicable.

Familiarize yourself with the dashboard layout to efficiently access different account features. The intuitive navigation makes it simple to find what you need.

Making Payments Online

Instead of mailing checks, you can securely pay your bill online through the Honda Finance portal by:

- Navigate to the “Make a Payment” section on the dashboard.

- Selecting payment method – debit card, credit card, checking account, etc.

- Entering payment details including amount, date, account number, etc.

- Choosing frequency – one-time or recurring payment setup.

- Checking details for accuracy before submitting.

- Recording the confirmation number for reference.

The available payment methods offer flexibility while modern encryption protects your financial data. Processing is quick so payments credited to your account faster.

Setting Up Autopay

For hassle-free payments, consider enrolling in the Honda Financial Services autopay feature. Here are the steps to set it up:

- From the account dashboard, select the “Manage Autopay” option.

- Pick autopay type – recurring or one-time as needed.

- Choose payment method – credit/debit card or bank account.

- Input the preferred card or account details.

- Select the payment date based on your salary or due date.

- Specify the payment amount to cover the minimum due or full balance.

- Check the terms and conditions before enabling autopay.

- Confirm setup and edit preferences anytime later.

With autopay activated, payments will automatically be deducted so you avoid late fees. Your account stays current without any effort.

Understanding Account Statements

You can view, download and analyze your latest account statements directly via the online portal. Just navigate to the “Statements” section. Key statement details include:

- Payment period, date, and account number.

- Previous and current balance.

- Minimum payment due and due date.

- Transactions like payments, fees, interest charges, etc.

- Year-to-date interest and principal paid.

- Customer support contact information.

Checking statements is vital for tracking your account health and payment history over time. Statements get updated monthly so review them regularly for errors.

Updating Personal Information

Keeping your account profile updated ensures you receive important communications. To change details like address, phone or email, follow these steps:

- Go to “My Profile” from the account dashboard.

- Click on “Personal Information” to edit details.

- Input a new address, phone number or email.

- Modify preferences like eStatement enrollment or communication method.

- Select “Save” to apply updates.

Informing Honda Financial Services of any changes right away prevents missed account alerts or statements. You can revise your details at any time for convenience.

Exploring Additional Online Services

Apart from core account management, Honda Finance provides other useful services through its online portal:

- Lease-End Options – Learn about purchase, lease extension or vehicle return steps before maturity.

- Account Alerts – Opt-in to receive payment reminders, due date notices, etc. via email or SMS.

- Honda Support – Access maintenance tips, vehicle manuals and more.

- Contact Us – Reach customer support to get account-related queries resolved.

- FAQs and Tutorials – View commonly asked questions and guides for the portal.

Digging deeper into the portal uncovers more tools for an all-encompassing customer experience.

American Honda Finance Corporation – Supporting Honda Owners

For over 40 years, American Honda Finance Corporation (AHFC) has provided lending services to support Honda customers in the United States. AHFC offers financing plans on Honda vehicle purchases and leases at participating dealers nationwide. They also provide comprehensive online account management tools.

Honda Financing Options

Whether you are looking to buy or lease a new or used Honda car, truck or SUV, AHFC provides financing solutions including:

- Auto loans with competitive interest rates and flexible repayment terms.

- Leasing plans with affordable monthly payments and options at lease-end.

- Lines of credit for flexibility in financing.

- Refinancing of existing auto loans to improve rates or payments.

- Vehicle protection plans for added peace of mind.

AHFC financing plans are tailored for Honda vehicles across the brand’s lineup. They may also offer special promotional financing rates.

Honda and Acura Vehicles Eligible for AHF Financing

Virtually every new and certified pre-owned Honda and Acura vehicle model sold in the U.S. is eligible for financing from American Honda Finance, including popular models like:

- Honda Accord, Civic, CR-V, Pilot

- Acura RDX, MDX, TLX

AHF is also able to finance Honda Certified Used Vehicles as long as they pass the rigorous certification process which includes an extensive inspection of over 150 points. These CPO vehicles can give you peace of mind while still getting attractive financing rates and terms from AHF.

Getting Pre-Approved with American Honda Finance

Getting pre-approved for financing is recommended before visiting your Honda dealer. This allows you to know the rates and terms you qualify for in advance. It also gives you negotiating power, as you already have financing lined up.

You can easily apply for pre-approval directly from the American Honda Finance website or through the My Honda and My Acura Finance mobile apps. You’ll need to provide your basic personal and employment details along with your desired vehicle model and trim level to get a real rate quote.

The pre-approval process is simple, taking just minutes to complete. You will receive a finance offer detailing estimated payment amounts and APR percentages along with the maximum loan amount, terms, and expiration date. This pre-approval is valid at any authorized Honda or Acura dealership nationwide for up to 60 days.

FAQs

American Honda Finance sets their minimum credit score requirement at 640, so customers with credit scores equal to or higher than 640 are more likely to be approved. Those will scores in the good to excellent range (690+) will qualify for the best rates AHF offers.

Yes, AHF usually offers several promotional 0% APR deals and other special rate incentives throughout the year, with terms from 36 to 72 months. These special rates may apply to certain models or even vehicles across the entire Honda lineup for certain time periods. Check with your dealer for the latest incentives.

Yes. AHF has a used vehicle financing program that includes competitive rates and flexible terms for Honda Certified Pre-Owned (CPO) vehicles as well as non-certified models no older than 10 model years.

Taking over the remainder of an existing auto loan on a Honda, also known as a lease assumption or credit transfer, may be possible based on certain qualifications. Interest rates and terms are set at the time the original lease was initiated however, so you assume those same rates.

American Honda Finance provides flexible financing terms from 24 to 72 months (6 years). Longer terms of 66 to 72 months have higher rates but lower monthly payments.

Yes. Adding a creditworthy cosigner to your AHF application can increase the chances of approval and help you qualify for better interest rates if you have limited credit history, low income, or past credit issues.

Conclusion

Whether you’re looking to finance a new Honda Civic or lease an Acura SUV, American Honda Finance offers all Honda/Acura customers great financing rates and terms to make owning or leasing your vehicle more accessible. Easy to apply, competitive interest rates, flexible payment schedules – AHF has plenty of benefits that make it a top financing choice for your next Honda or Acura. Considering financing for your Honda vehicle purchase? We suggest starting with a pre-approval from American Honda Finance to take advantage of exclusive offers.